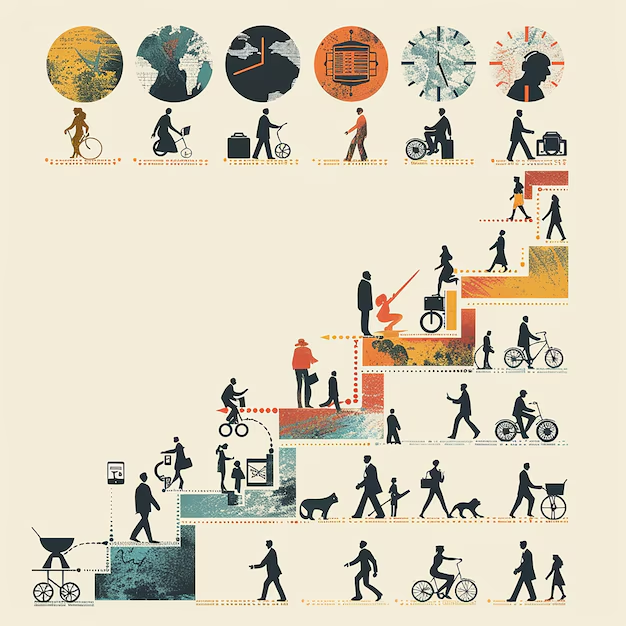

The Evolutionary Pursuit of Improvement 🌟 Human history is a testament to our unyielding drive to improve and evolve. From primitive communities to modern societies, our quest for better living standards has shaped civilisations. 🌍 This inherent pursuit, deeply embedded in our nature, continues to influence societal development and aspirations in profound ways.

Globalisation and Raised Expectations 🌐 The advent of globalisation has interconnected the world like never before, exposing people in developing countries to global standards of public services and lifestyles. 🌆 As awareness grows, so does the demand for enhanced infrastructure, healthcare, and other essential services. 🏥 This mounting pressure challenges governments to meet rising expectations while navigating limited resources and fiscal constraints. 💰

The Burden of Taxation and Public Trust 🏛️ Taxation is a cornerstone of societal progress, funding the development of public goods and services. However, the cumulative effect of multiple taxes often places a significant burden on individuals, especially in developing economies. 💸 Transparency becomes crucial in this context. By making data publicly accessible and fostering public scrutiny through audits and clear metrics, governments can address corruption, enhance accountability, and rebuild public trust in the efficient utilisation of tax revenues. 🔍

Ensuring Fair Taxation with Visionary Leadership 🤝 In a world of stark income disparities, taxation systems must strike a balance between equity and efficiency. ⚖️ This requires visionary leaders who understand the complexities of taxation and its socio-economic implications. Such leaders can devise strategies to ensure that basic services remain affordable for low-income families while fostering a fair tax structure that encourages growth and innovation. 🚀

Managing Change and Embracing Innovation 🔧 Progress inevitably brings new challenges. The key lies in effectively managing these hurdles while embracing innovation. 💡 By leveraging technology, governments can streamline tax collection, reduce inefficiencies, and foster a more inclusive system. 🌈 This adaptability reflects the core essence of human evolution—our ability to learn, innovate, and overcome. 🧠

Toward a Balanced Future 🌟 As we navigate the complexities of taxation and public service in a globalised world, the path forward requires a collaborative effort. 🤝 Transparency, accountable governance, and visionary leadership are essential to ensure an equitable and prosperous future. 🌟 By recognising the intrinsic drive for improvement and addressing challenges proactively, societies can create a balanced system that benefits all citizens. 🏡

Taxation, when managed effectively, becomes more than a fiscal tool; it transforms into a vehicle for societal growth and shared prosperity. 🚀 Let us harness this potential to shape a world that thrives on fairness, innovation, and collective progress. 🌍